Interview: Elizabeth Kraus

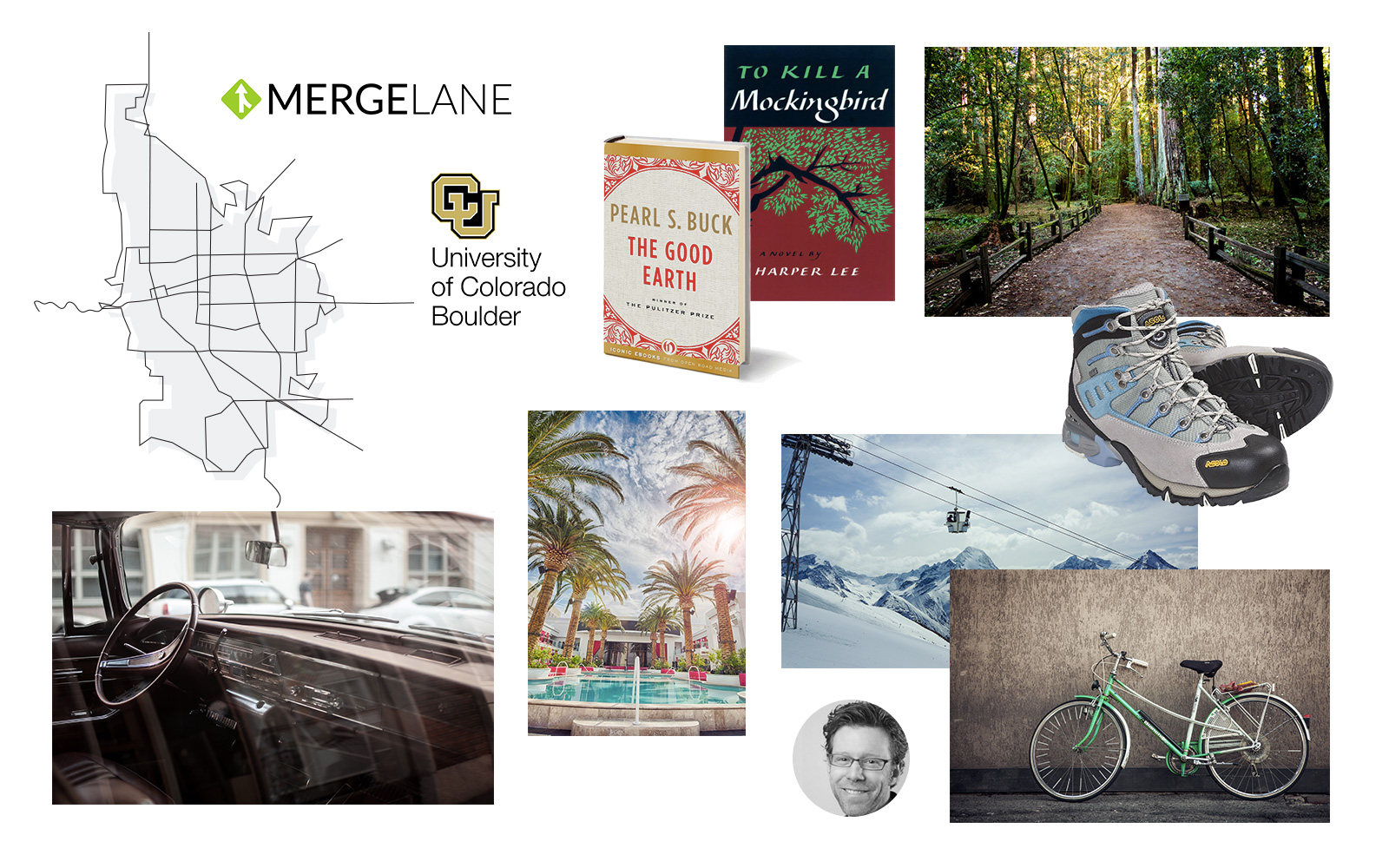

In this edition of Lived It, we sit down with Elizabeth Kraus, the co-founder and Chief Strategy Officer of MergeLane, a 12-week program designed to discover, accelerate, and invest in exceptional women and the companies they run.

By working for a startup when she was fresh out of college, and then founding her own, Elizabeth began to get familiar with the investing process early on. Her startup, MyUSearch, only ended up using funds from friends and family, but the team also considered raising money from angel investors. Now, Elizabeth matches companies with strong female leadership with investors, coaches, and other resources to accelerate their business.

In this interview, we talk to Elizabeth about writing cheques you’ll never see again, why you should risk a bit more to get a better return, and how to close deals in a tank top, shorts, and running shoes.

Meet Elizabeth

Years as an angel investor: 6 years Number of investments: 36 direct investments

A day in the life of Elizabeth

Get up and have breakfast

Work on emails and independent work

Go work out.

Do some follow-up emails, and research online, or meet with potential investors, or potential companies for the Mergelane program.

At about 3:00 p.m: Do hiking meetings, either with investors, or with companies that she’s interested in investing with.

Dinner at home

Work for about three more hours at night

Overall she splits her time about 50/50 between meetings and emails.

First Investments

“When I left MyUSearch, I decided that I’d rather help entrepreneurs learn some of the really hard lessons that I had learned rather than start another company. I started just going to some meetups to figure out how I could best do that. I went to this event at Boulder Startup Week, called, “How to become an angel investor.” The event was hosted by David Cohen, the founder of TechStars, and Brad Feld, another founder of TechStars and head of one of the managing partners at Foundry Group.”

“I just asked, ‘What does it take to be an angel investor?’ Their answer was to be able to write at least two cheques per year at about $25,000, and to be able to write those cheques with the idea that that money will never come back. I thought, I have the resources to do that. I really wanted to make an investment, so that I would be a “real investor.” Then I went to TechStars’ demo day, and invested in one of the companies.

“My family thought I was crazy, because I grew up in Michigan. My brother is going to be the third generation owner of our family business. They live in an area that is mostly blue collar workers, so there’s really not much startup activity. They thought this was crazy. Interestingly, that was seven years ago, and now both my parents are investors in MergeLane, as well as some of the other investments that I’ve made. So far they seem to be pretty happy about that, so they came around.

“The main reason why I invested is because I really wanted to make one investment so that I was a ‘angel investor.’ The CEO of the company regularly came to my fitness classes. After making that connection, I made an investment – my first ever.”

“I quickly figured out that that was not the best strategy for investing, and realized that I had a lot to learn. Out of that, I built a network of people that were also interested in investing, and eventually had a pretty large network of people to invest with.”

Other Investments

Instead of Elizabeth seeking out other investments the same way as her first, she admits that most – save for the ones through MergeLane – actually found her. By making public her interest in angel investing, involvement with the Boulder startup community, and speaking engagements, she hasn’t felt the need to seek them out. Elizabeth hosts a monthly hike for entrepreneurs, and several investments have been made through those connections.

“MergeLane does about 10 deals per year, and I think we’re going to look at close to 1,000 companies to get those 10. When I was running Impact Angel Group, which I founded prior to this, our statistics were pretty similar. We would invest in somewhere between one percent and two percent of the opportunities that we saw.”

“I also like to give the caveat that that’s a scary amount of activity for individual angels to take on. But we are running an organization that does the initial filtering, so our investors in our network get to look at those 10, then decide which companies they want to invest in, and they’ve already had that filtering. It’s similar to when I was running an angel group; we would look at almost 1,000 deals a year, and then we would only show about 50 of those deals. Ultimately we would invest in 10 to 20 of those.”

Why do you angel invest?

“Originally, I started angel investing because I was an entrepreneur myself, and I am in Boulder, Colorado, which is a really strong startup community. I quickly figured out that I wanted to keep doing it because I think that there’s really nothing more rewarding than helping people who are so passionate about what they’re doing, that they’ll stop at nothing to make that happen. I wanted to keep doing it, and I found that it’s one of the most interesting things that you can possibly do, because you’re always meeting such passionate people that are doing totally different things. On any given day, I might be learning about treatment for melanoma. One of my coolest experiences was when I got to go a lab to see this technology that was breaking up tumors with nanotechnology. Or it could be something that I never thought that I would be that interested in, like figuring out how to mine email data to better connect with people. The founder is just so passionate about that technology and their business, that I fell in love with the business, too. It’s just infectious.”

Deal Flow

Elizabeth has about 185 companies she is currently involved with, so she says she’s not very actively involved at all in their day-to-day operations. Her gift is being a “connector” and making meaningful connections to people that will impact the business.”

“I’ve invested personally in about 35 companies directly, and then about 150 companies through funds, and I’ve only led about eight of those deals. Most of the time, I was actually following other angels that I knew, and trusted, who were proposing fair deal terms.”

Elizabeth uses AngelList to find investment opportunities, and even invested as an individual in the Foundry Group syndicate. She says she uses Gust occasionally because she is a member of Investor’s Circle, the largest angel investing organization focused on impact investing, which is of particular interest to her. But she found that her best source of deal flow has truly been by building relationships with other investors, and working with accelerators.

“I co-founded an accelerator because I think accelerators are the best way to figure out whether you want to invest in the company. There’s no better way to determine whether you want to invest in a team, than to have the opportunity to work side-by-side with them. The advantage of an accelerator, as an investor, is that you can either become a mentor, and have the opportunity to work side-by-side with those companies, or you can build relationships with other people who are mentoring for those companies to get a better feel of what it’s like working with them, and to determine whether you want to make an investment.”

“There’s no better way to determine whether you want to invest in a team, than to have the opportunity to work side-by-side with them”

When Elizabeth has decided she wants to invest in a company, she says the negotiating process tells her a lot about what the potential relationship will be like. MergeLane approaches negotiations by spending a lot of time talking to lawyers, entrepreneurs, and venture capitalists across the country to get a good understanding of the market and what are fair terms. When they proposed the terms, they are then able to explain to the entrepreneurs the reasoning behind the terms.

“Smart entrepreneurs who have also done their homework and who understand the value that we’re bringing to the table, will not negotiate and nitpick every term. Entrepreneurs who aren’t in that category have, in some cases, actually made us pull out of the investments. I saw that more with my role in running an angel group than I have with MergeLane, because they’re already working more closely with the teams, but I think it’s really important to think about, as an individual angel investor.”

"I started making investments in companies that I felt were less risky but had also less upside. They weren’t growth businesses but were looking for angel capital. I’ve actually found that the businesses that I thought were the least risky, have been my worst investments."

Thesis

“My primary focus now is on MergeLane, which is focusing on companies with at least one woman in a leadership position. That’s our first criteria, and then beyond that, we’re really industry and geography agnostic. What we look for is exceptional teams. I like to invest in people that are incredibly passionate about what they are doing, and businesses that are tied to their deep, personal passions. I also just ask myself some questions about if the tables were turned, would I feel really good about asking this person for advice? Do I trust this person wholeheartedly, without question? They’re really, pretty simple questions. On top of that, I just ask whether they’ve done what they promised, on time and as delivered, or if they’ve communicated why they haven’t done that. So, just simple things, like if they tell you that they’re going to send you documents and it comes a week later, and things like that are red flags. I’ve just learned, over the years, that if you follow the very basic criteria for what you have looked for in someone you wanted to date, or someone you wanted to hire, that really weeds out the majority of companies that aren’t going to be good investments.”

There are many differences between Elizabeth’s approach to personal angel investments compared to the ones she supports through the MergeLane fund. “As an individual investor, I typically write cheques between $5,000 and $50,000. Through MergeLane, we write checks of up to about $100,000, so it really just depends on which venue I’m going through.” Depending on how involved Elizabeth is with the deals she makes in personal angel investments, she will bring in her own lawyer and accountant to assist with the deal.

“I’ve actually found that the businesses that I thought were the least risky, have been my worst investments.”

“If I was not leading the deal and the person leading the deal had both a lawyer and experience that I trusted, then I didn’t bring in my own lawyer. I’ve always had my own accountant, but I didn’t have my own lawyer. But if I’m leading a deal, I definitely have a lawyer. MergeLane uses Bryan Cave, which is an international firm. I learned pretty quickly in the process that this stuff is fairly complicated, and if you don’t have a lawyer that has experience in investing and startups, then they’re going to make it even more complicated, both for you and for the entrepreneur. You’ll end up spending more money, even though they may charge less per hour.

“I’ve also found investment advisers to not be helpful at all with startup investing for some of the same reasons. They just try to apply the principles of understanding risk in the public market to a startup, and it really doesn’t work.”

Elizabeth has cultivated a sophisticated thesis through trial and error, and says some mistakes she made early on in her investment journey helped her to learn that she had to take on more risk to see the returns she was looking to make.

“I like to invest in people that are incredibly passionate about what they are doing, and businesses that are tied to their deep, personal passions.”

“I started making investments in companies that I felt were less risky but had also less upside. They weren’t growth businesses but were looking for angel capital. I’ve actually found that the businesses that I thought were the least risky, have been my worst investments. These businesses didn’t have a lot of upside. If you’re going to get into angel investing, you just have to take on that risk, and go for the companies that are really going to make the big returns rather than trying to find ones that you can spit into the angel dollar amount, but not the right risk amount.”

Elizabeth manages risk in the same way she has since she began angel investing and the assumption that she will never see her money again once she writes a cheque becomes a welcome surprise when she sees a deal through to an exit.

“I just had an exit, got a cheque in the mail, and I sometimes forget that the money comes back. I’m 100 percent in this to make money, and I invest through that lense. But, at the same time, because it is so risky, once I write that cheque, I just assume it’s never coming back.”

For aspiring angel investors:

“I think the hardest things about angel investing, in general, is saying no. All of these people are so passionate about what they’re doing, and if you’re a smart investor, you’re going to be saying no a lot more than you’re going to be saying yes. That’s very emotionally hard to do. I learned how to say no, with grace, which is probably the best weapon that I’ve learned.”

“The second thing is to trust your gut. Any time you start to feel like it just isn’t feeling right, you should get out. It’s really hard to have the discipline to do that, but it’s really important to do that.”

“I think the hardest things about angel investing, in general, is saying no.”

“The third thing is, it’s really a lot like dating. Sometimes, the first date is good but not fantastic, and then if you go on a second date, and it’s still not great, you just need to move away. In this business, such a small fraction of the companies are going to be successful, and you just have to keep remembering that you’re looking for the best one percent. The minute you start to feel like they’re not exceptional, you just need to walk away.”

“The other important thing that I tell new angel investors is, you should look at 20 deals before you make an investment, because you’ll start to see the differences in quality, and you’ll start to see some pattern recognition. I think that’s really key before making an investment.”

“Just take the leap. It’s scary, it’s risky, but it’s a lot of fun. You just have to agree on a dollar amount, and start doing it.”

In addition to the observations and gut checks that need to happen before making your first investment, Elizabeth said coming up with a plan that you’re comfortable with makes the risk much easier to mitigate because you have a solid understanding about what you are about to do with your money.

“I would figure out a budget for the year. Come up with a dollar amount, and then divide that by 10, and be really disciplined about making those 10 investments in the year. The reason for that is because angel investing is really risky. You need to have a diversified portfolio to cover that risk. I would also suggest looking at 20 deals to start to recognize patterns before you make one of those investments. Then, I would recommend just really spending as much time as possible building relationships with other investors, and with influencers in the community that can both help to refer you deals, and also help to better understand the opportunity, because they have varying industry expertise.”

Elizabeth has one final piece of advice for female angel investors: “Just take the leap. It’s scary, it’s risky, but it’s a lot of fun. You just have to agree on a dollar amount, and start doing it.”

“The people who are most likely to invest in you are people who have had the opportunity to work side-by-side with you and believe in you.”

For entrepreneurs wanting to raise angel capital:

“Look to the last 10 years of your life first. The people who are most likely to invest in you are people who have had the opportunity to work side-by-side with you and believe in you. If you don’t have anyone like that, who is willing to make a bet on you, you might want to rethink your idea. People are going to other angels.”

For entrepreneurs trying to get in touch:

“I’m really focused on companies with at least one woman in leadership right now, and if they fall into that category, I would love to talk to them. They can email me at Elizabeth@MergeLane.com, or apply at MergeLane.com.”

Elizabeth recommends reading:

Venture Deals, and The Twenty Minute VC Podcasts, by Harry Stebbings. He also has a new podcast called Angel Insights, which focuses on angel investors.

Subscribe to our Newsletter

Get investment education, interviews with angels and VCs, and exclusive event access.